How much money should Oakwood City Schools hold in reserve? This is the levy’s central question. I’ve reviewed the data and spoken with district officials. Here’s what I’ve learned:

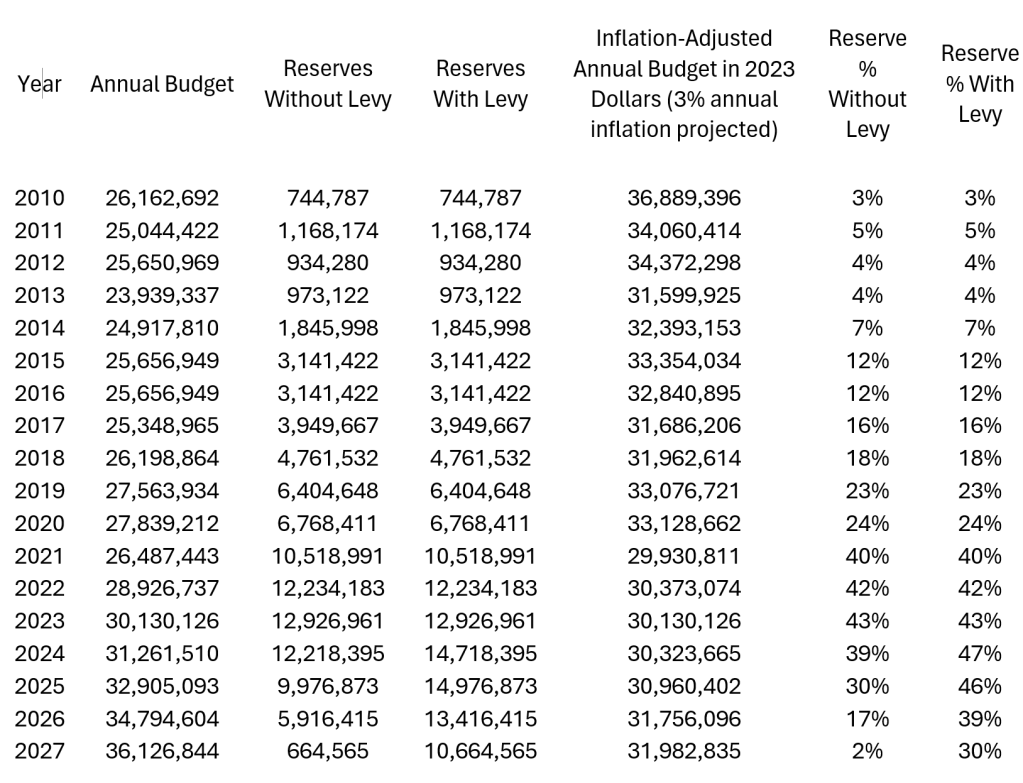

Ten years ago, our district had no significant reserves, going from surplus to deficit between levies, and sometimes borrowing money. Any levy failure carried immediate consequences. As Figure 1 shows, that has changed.

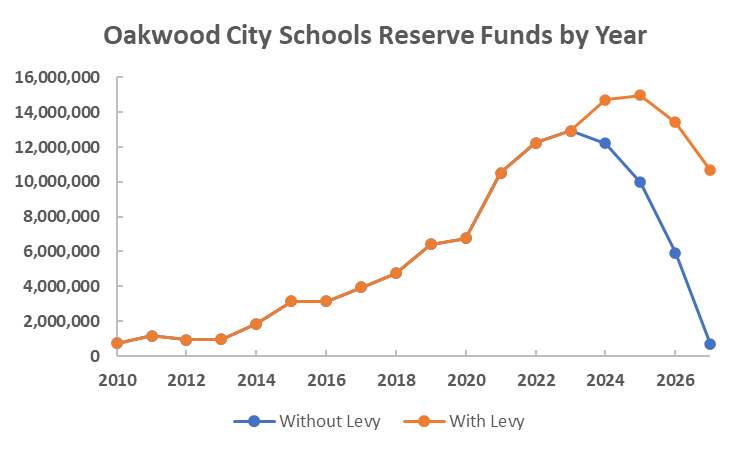

Since 2013, our district’s reserves have grown. Like personal emergency funds, these reserves provide security against setbacks like unplanned and significant infrastructure expenses, stability of operations in case of levy failures, or resources for unanticipated unfunded requirements. Current reserves are $13M, or 43% of 2023’s budget. Figure 2 shows reserves as a percentage of annual budgets, which flattens recent and projected increases.

For context:

- Today’s reserves could fund 5 months of operations without income.

- Our district could operate until 2027 without any levy. Then we would have to make cuts or pass a levy more than twice as large as this year’s levy.

- Current reserves provide $650K in annual revenue.

- This levy would raise reserves to 47% of the 2024 budget. This figure would hover at 46% in 2025, then drop.

- Rejecting this levy would cap reserves now at 43%. With smaller tax revenues and reserve investments, reserves would fall faster.

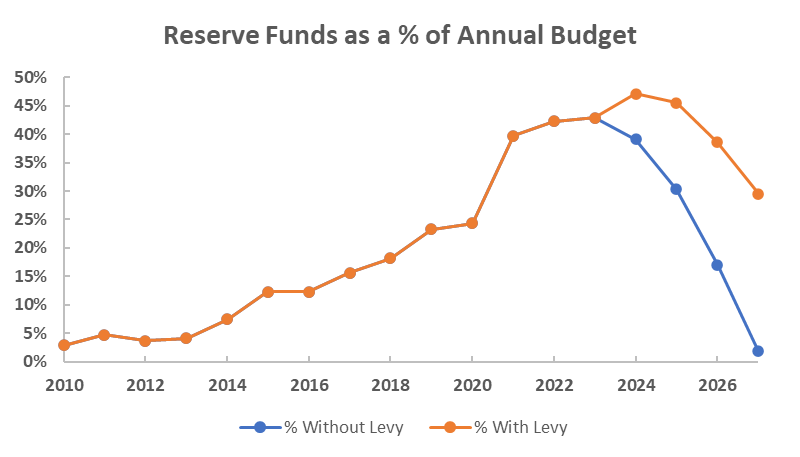

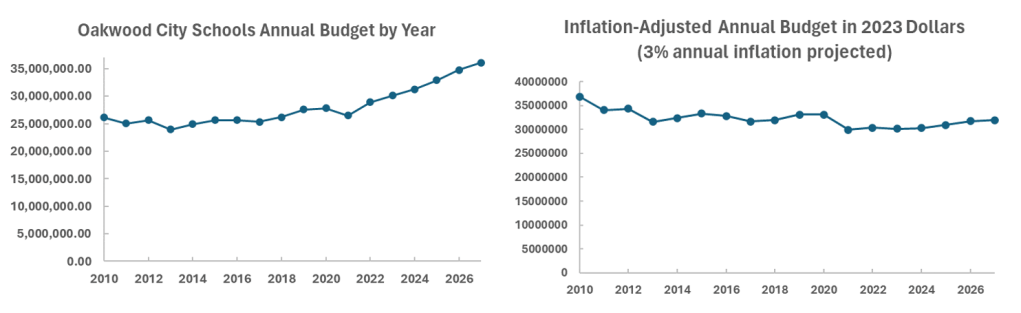

It’s reasonable to question our district’s spending habits. Figure 3 shows budgets since 2010. Corrected for inflation, spending has been flat since 2013.

District leaders say they won’t grow these reserves indefinitely. Eventually, the district will shift to sustaining reserves, proposing smaller levies or waiting longer between levies. Without borrowing, we’ll return to fluctuating between surplus and deficit.

Thus, the levy’s central question is: How big should these reserves be? We might consider a floor and ceiling for these reserves.

We could reach a ceiling of 50% with this levy and something similar in a couple of years. If you want that, you should vote yes. There are sound reasons for large reserves. This would be a public commitment to sustain our district’s excellence: a literal vote of confidence helping to keep property values high. Larger reserves increase stability, empowering leaders to plan with confidence. Larger reserves also mean more non-tax revenue.

If you prefer smaller reserves, you should vote no, understanding that future tax hikes to avoid hitting a reserve floor must be larger than this levy. There are reasonable arguments for smaller reserves. Sustained surpluses discourage thrift. Although inflation-adjusted budgets have been flat, that might not continue. Our levy approval streak since 1978 may foster complacency in our schools’ partnerships with parents and volunteers, an atrophied partnership that has yet to recover to pre-pandemic levels at some schools. Taxpayers can also seek better returns with their tax savings than Oakwood Schools can. Our district faces no financial crisis, nor will it if this levy fails. The strength of Oakwood’s community and schools transcend any levy. However we vote, we can build this strength by engaging, volunteering, and partnering with our schools to give our kids the best upbringing we can provide.

Article Credit: Will Erwin

Notes on data and methods:

Data was assembled from historical and projected data gathered from 5-year forecast reports at https://education.ohio.gov/Topics/Finance-and-Funding/Overview-of-School-Funding

Projected budget assumes no cost cutting and includes revenues from invested reserves and expected increases from inside mills with 2023 home reappraisals. Data from https://education.ohio.gov/Topics/Finance-and-Funding/Overview-of-School-Funding

Inflation-adjusted dollars were calculated with https://www.usinflationcalculator.com/

I assumed 3% annual inflation for each year moving forward with inflation-adjusted dollars.

Data used to generate graphs: